The UAE is quickly becoming a hub for technological innovation, with businesses across the country adopting cutting-edge solutions to stay ahead of the curve. At the forefront of this digital transformation is the Point of Sale (POS) system. A game-changer in how transactions are handled, inventory is managed, and customer experiences are enhanced. With the UAE's strong push toward a cashless economy, POS systems have become a vital part of the business landscape, transforming industries from retail to hospitality. In this blog, we’ll take a closer look at the booming POS market in the UAE, explore the factors driving its growth, and discuss what the future holds for businesses embracing this powerful technology. Ready to discover how POS systems can shape the future of your business? Let’s get started!

With the government's strong focus on digital transformation and a population that’s quick to embrace technology, the POS payment market in the UAE is experiencing impressive growth. According to Markets and Data, this market is set to expand at a rate of over 10% annually from 2023 to 2028. The shift towards cashless payments, advancements in mobile POS (mPOS) technology, and the increasing use of POS systems across industries like retail, hospitality, and services are all contributing to this exciting upward trend. As businesses adapt to these changes, the UAE’s POS market is becoming a key player in the region’s digital economy.

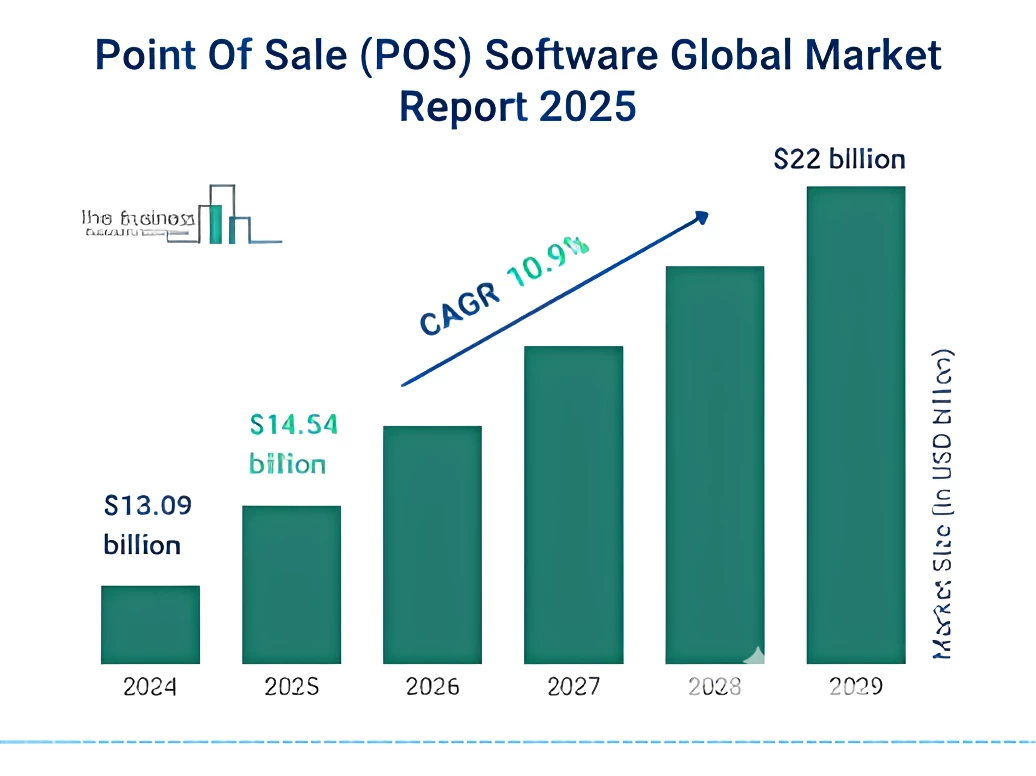

The Point of Sale (POS) market has experienced significant growth in recent years. It's expected to rise from $44.84 billion in 2024 to $53.84 billion in 2025, growing at an impressive rate of 20.1% per year. This growth is driven by several key factors: businesses wanting to offer better customer experiences, the boom in online shopping, the rise of digital payments, more small and medium-sized businesses entering the market, and the increasing popularity of mobile and cloud-based solutions. As these trends continue, the POS market will only keep expanding, making it a crucial part of business growth in today’s digital age.

The UAE government has been actively encouraging cashless payment methods as part of its vision to build a smart economy. Initiatives such as the Smart Dubai project and the UAE Central Bank’s National Payment Systems Strategy aim to reduce reliance on cash, making POS systems indispensable for businesses of all sizes.

Modern POS systems offer more than just payment processing. They streamline inventory management, provide sales insights, and enable customer relationship management (CRM), helping businesses improve efficiency and profitability.

From high-end retail outlets in Dubai to traditional souks in Sharjah, POS systems cater to the diverse needs of UAE businesses. The versatility of these systems ensures their relevance across sectors like retail, restaurant, and tourism.

Today’s consumers expect quick, easy, and secure payment methods. Whether they are shopping online or in-store, they prefer payment systems that are simple to use. POS technology is evolving to meet these expectations, offering features like mobile wallets, QR code payments, and contactless options. As more consumers demand seamless and faster transaction methods, businesses are rushing to upgrade their POS systems to meet these growing needs.

With the popularity of digital wallets like Apple Pay, Samsung Pay, and Google Pay on the rise, more consumers are opting for these convenient, secure, and efficient payment options. POS systems that support a wide range of digital wallets are becoming essential for businesses that want to offer a flexible, cashless experience. As smartphone penetration in the UAE is high, businesses are adopting POS solutions that allow customers to pay directly from their phones, enhancing convenience and security.

Self-checkout solutions are gaining popularity in retail and grocery stores, where customers prefer to scan and pay for their items without waiting in long lines. These POS systems not only improve customer convenience but also streamline store operations and reduce labor costs. With more stores adopting self-checkout kiosks and mobile self-checkout apps, the demand for these types of POS systems is expected to rise, driving market growth.

Cloud-based POS systems are gaining traction in the UAE due to their scalability, cost-efficiency, and remote accessibility. These systems enable business owners to monitor sales and inventory in real time, even across multiple locations.

AI-powered POS systems are revolutionizing customer experiences by offering personalized recommendations, fraud detection, and predictive analytics. Businesses can use AI insights to optimize inventory and improve customer retention.

The portability of mPOS systems makes them ideal for small businesses and on-the-go transactions. Their popularity is rising, particularly in sectors like F&B delivery and event-based retailing.

Blockchain technology is expected to enhance the security and transparency of POS transactions. Although still in its infancy, blockchain integration is poised to play a significant role in the future of POS systems in the UAE.

Smart Payment Terminals Smart payment terminals are revolutionizing the traditional point-of-sale hardware. These advanced terminals not only process payments but also offer features like inventory management, customer loyalty programs, and sales analytics. They are designed to be easy to use, integrating various functionalities into a single device, making them particularly attractive to SMEs and fast-paced businesses.

With voice assistants becoming a part of everyday life, some businesses are exploring the use of voice-activated POS systems. These systems enable cashiers and employees to use voice commands to process transactions, check inventory, or generate reports. This hands-free functionality can speed up the payment process, improve accuracy, and reduce human error, particularly in busy environments like retail stores and restaurants.

While the market is booming, it is not without its challenges:

For businesses in the UAE, upgrading to a modern POS system offers several advantages:

Modern POS systems are more than just tools for processing payments. They integrate with customer relationship management (CRM) systems, provide detailed analytics, and enable businesses to manage inventory in real-time. This makes it easier for businesses to streamline their operations, optimize their sales processes, and improve customer satisfaction.

Although advanced POS systems may come with an initial investment, they often provide long-term savings. With features like real-time inventory management and automated sales reporting, businesses can reduce operational costs and improve the accuracy of transactions.

POS systems are critical to enhancing the customer experience. Fast, secure, and easy-to-use payment options—such as contactless and NFC payments—ensure that customers enjoy a seamless transaction process, whether they are shopping in a store or dining in a restaurant.

The UAE is on track to become a global leader in digital payment innovation, with POS systems playing a critical role. Key factors shaping the future include:

The Point of Sale (POS) market in the UAE isn’t just growing—it’s transforming the way businesses operate and connect with customers. With strong government backing, a tech-savvy population, and a booming business landscape, POS systems are quickly becoming a key pillar of the UAE’s digital economy.

These systems are doing more than just speeding up transactions—they’re helping businesses run more smoothly and offering customers a seamless, cashless experience. As the UAE continues to lead in innovation, businesses that embrace advanced POS technology will have the edge in this fast-paced and competitive market.

By choosing the right POS solution today, businesses aren’t just staying ahead of the game—they’re actively supporting the UAE’s vision of becoming a global digital commerce leader. The future is here, and it’s all about making smart, tech-driven choices that open doors to new opportunities and success.